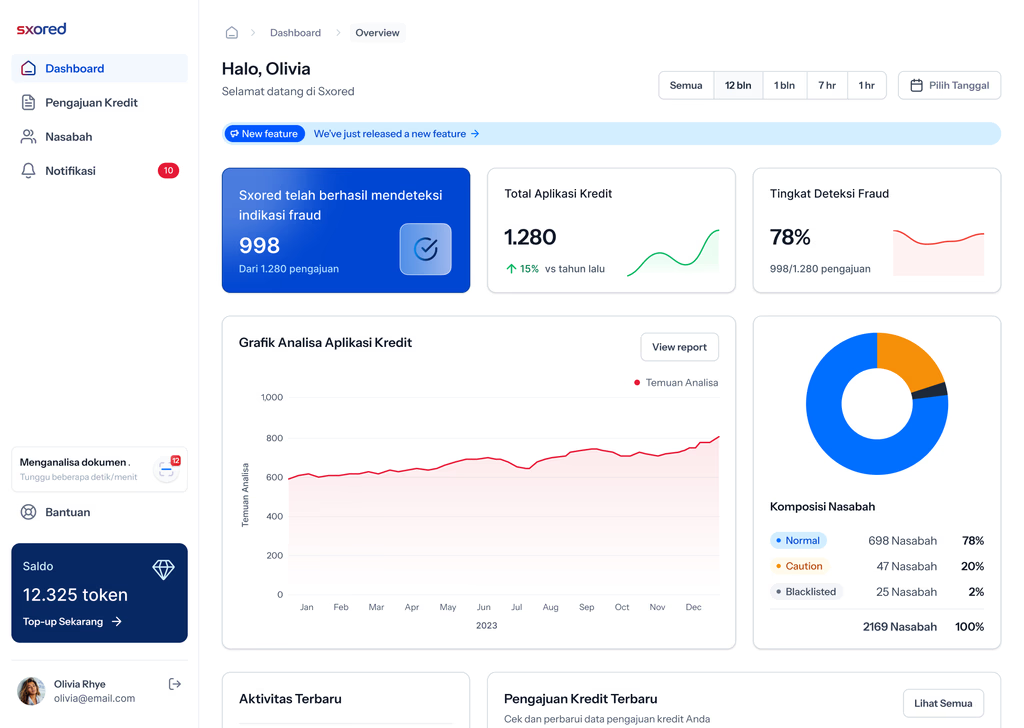

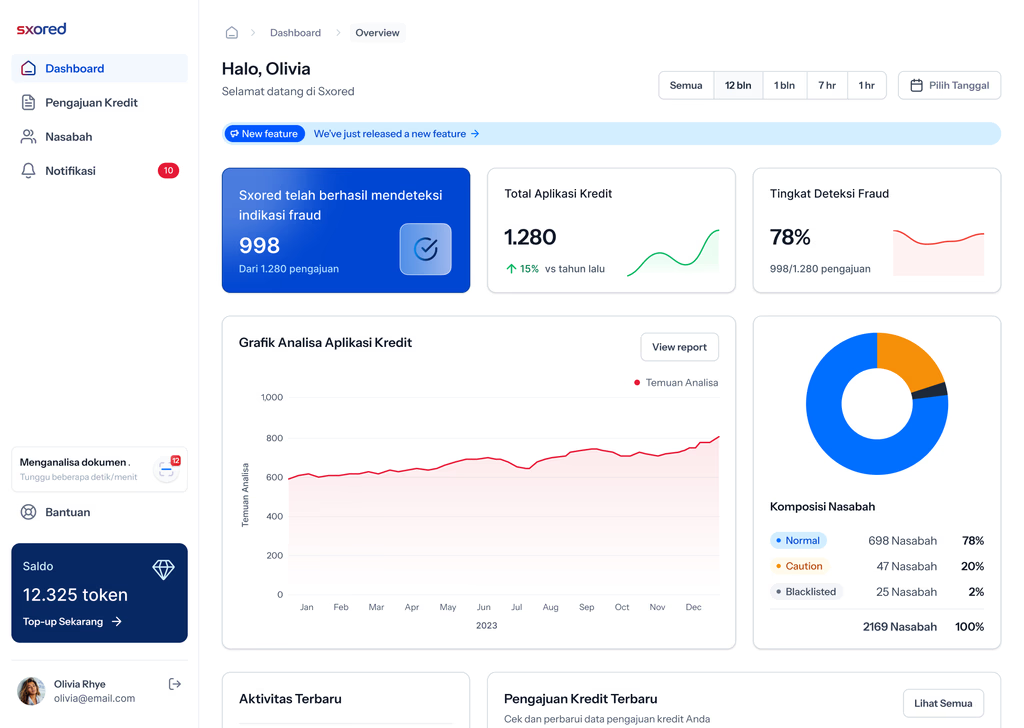

Transform Lending with AI-Powered Document Intelligence

Automate credit document processing, detect fraud, and accelerate loan underwriting with our intelligent OCR and AI copilot solution.

Automate credit document processing, detect fraud, and accelerate loan underwriting with our intelligent OCR and AI copilot solution.

Our AI-powered platform combines advanced OCR technology with machine learning to revolutionize how lenders process and analyze credit documents.

Extract and consolidate data from e-statements across Indonesia's major banks with unprecedented accuracy and speed.

Advanced AI algorithms identify potential manipulation and document tampering with over 10 sophisticated detection indicators.

Generate concise borrower summaries and support rapid property collateral appraisal with market value assessment.

From document processing to decision-making, our platform covers every aspect of the lending workflow.

Reduce loan processing time from days to hours with automated document analysis.

Eliminate human error and ensure consistent, accurate credit assessments.

Significantly lower operational costs through automation and efficiency gains.

Founded in 2024 by experienced fintech professionals, now supported by East Ventures.

Founded in June 2024, Sxored emerged from a team of seasoned fintech professionals who previously built and successfully exited a mutual fund marketplace. Today, our team of nine experts is united by a shared vision to transform financial services through cutting-edge AI solutions.

With significant traction including 10 ongoing pilot implementations across banking, fintech, and venture capital sectors, we're proving our platform's technical robustness and real-world impact in high-stakes environments.

Join leading financial institutions already using Sxored AI to accelerate their lending operations.